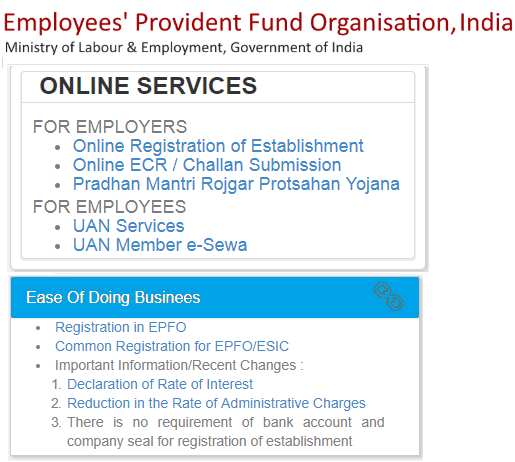

Services offering in the Employees’ Provident Fund Organization [EPFO] Website i.e https://unifiedportal.epfindia.gov.in….

The Employees’ Provident Fund is an initiative started by the Indian government for the sole purpose of saving money that would be used once one retires. The Employees’ Provident Fund is managed by Employees’ Provident Fund Organization (EPFO) which is under the government of India. Through this program, employees’ are required to give out a given percentage of their salary that will then be used once they retire. This initiative has helped many people as they are now able to survive easily once they have been rendered jobless.

How to Read your PF Statement

Contribution made into the Provident Fund is usually part of your salary and an employee can be able to see the amount of money deducted by simply checking their monthly pay slips. In order for an employee to get all the details concerning this contribution, it is necessary that you search for a PF statement which contains all the payments made by the employee and employer.

Services in unifiedportal.epfindia.gov.in website

At the end of every financial year, employees are given a PF statement after collecting it from Employees’ Provident Fund Organization (EPFO). This PF statement contains details such as:

- PF Account Number

Before you can have a look at anything else, it is advisable that you start by viewing your PF account number. For people working in an UN-exempted organization, the PF number is represented by a number that represents the regional office, state, PF member code and establishment.

- Basic details

Basic details such as name of the establishment, name of the employee, date of birth and address of the establishment are included in PF account number.

- Withdrawals

Also included is the withdrawals made during the entire year while working in a given organization. Through the PF account number, it becomes easy to trace all transactions carried out in a given month or year.

- Interest

As you start saving with the Employees’ Provident Fund Organization, there are some interest that will accrue on the contributions. At the end of every financial year, all the interest accrued from the employer and employee’s contributions are included in the PF account number.

- Opening Balance

The PF account number contains the opening balance which represents all the contributions made by an employee together with total interest earned.

- Closing Balance

The closing balance is usually a representation of the total contributions made an employee together with their interests. Furthermore, it also contains the total contributions made by an employer together with the accrued interest.

There are four methods that can be relied upon when reading your PF statement. They include:

- Sending a text message

- Using the EPFO Website

- Using the EPFO application

- Giving a missed call

Sending a Text Message

An employee can only get their PF statement through an SMS if they have integrated their UAN number with KYC details. Once this is done, a person can the use the steps below to get the PF statement.

- Send EPFOHO UAN ENG message to 7738299899

- In order for you to send this message, it is advisable that you select the most suitable language which will make it easy to accomplish everything. Once the message has been delivered, you will be able to get your PF statement as a text message.

Using the EPFO unifiedportal.epfindia.gov.in Website

Before you check your PF statement on https://unifiedportal.epfindia.gov.in/ website, you have to ensure that your employer has activated your Universal Account Number (UAN). After successfully activating the UAN, use the simple steps below to read your PF statement.

- On your browser, type https://unifiedportal.epfindia.gov.in/ as the official link of Employees’ Provident Fund Organization (EPFO) Website.

- Once in the website, select the services tab from where you can then click on ‘For employees’.

- In the website, click on ‘Member passbook’ option from the services tab. This action will generate a login page.

- Now enter your UAN number and password to log into Employees’ Provident Fund Organization (EPFO) Website.

- After logging into the site, you can check your PF statement.

Giving a missed call

It is also possible to get your EPF balance and statement by simply making a missed call to an authorized number using your registered mobile number. This option can only be used once you have integrated your UAN with KYC details. With this in place, it becomes easy to make a missed call to 011-22901406 by using your registered mobile number. Once the missed call has been initiated, a message containing all your PF details will be sent to you.

For Employers

There are three main services offered to employers on this portal and they are:

- Online Registration of Establishment

This gives you an option to either login to your account if you have one or creating an account with Shram Suvidha Portal. There are very simple steps followed to login to the site and all you need to do is:

- Fill in your user Id.

- This is followed by the password.

- And the last part is filling in the verification code and you’ll be set to login.

2. Online ECR / Challan Submission

Employee Provident Fund Organization launches online receipt issue of ECR (Electronic Challan Cum Return). This service has been available since April 2012. All employers were requested to Register their establishments by creating their user ID and a password through this portal.

The employer then gets an option of uploading the Electronic Return. Once this is uploaded, return data is displayed via a digitally signed copy that comes in a PDF format. The PDF can also be printed if the employer so desires. Once the employer approves the ECR online, Challan will be popped depending on uploaded return. In case there is need of making any payments, they can either be done by taking a printed copy of the Challan and making payment in any branch of SBI (State Bank of India) that have been designated for the same or via internet banking of SBI.

Applying for an EPF Withdrawal Online

With the new EPFO website, it is now possible for employees to submit their EPF withdrawal application within a matter of minutes. This can be done using the step by step explanation given below:

- On your browser, enter https://unifiedportal.epfindia.gov.in/ as the official link of EPFO Website.

- Log into the account by using your UAN number and password.

- Once in the site, click on ‘Manage’ tab and select KYC to see whether your KYC information is correct and verified.

- On the Online services tab, click on ‘Claim’. This action will automatically redirect you to the claim page.

- Click on ‘Proceed for Online Claim’ to continue submitting your claim. This should be done once you have selected the claim that you want i.e. EPF part withdrawal of EPF settlement.